Individual Retirement Arrangements(IRAs)

1. 의의 :

personal savings plan that gives you tax advantage for setting aside money for retirement

2. IRA Tax 혜택은 어떻게 되나요?

- contribution you make to an IRA may be fully or partially deductible.

- generally, amounts in your IRA(including earnings and gains) are not taxed until distributed.

3. Traditional IRA 은 누가 개설할수 있는가요?

You can open and make contribution to traditional IRA if

- you(or, if you file a joint return, your spouse) received taxable compensation during the year,

and

- you were not age 7 ½ by the end of year.

- If both you and your spouse have compensation and are under age 70½, each of you can open

an IRA. You cannot both participate in the same IRA. If you file a joint return, only one of you

needs to have compensation

4. IRA 개설시 요구하는 "Compensation" 이란 무엇인가요?

Wages, salaries, etc : Wages, salaries, tips, professional fees, bonuses, and other amounts you

receive for providing personal services are compensation.

Commissions : An amount you receive that is a percentage of profits or sales price is

compensation.

Self-employment income : If you are self-employed (a sole proprietor or a partner),

compensation is the net earnings from your trade or business

Self-employment loss : If you have a net loss from self-employment, do not subtract the loss

from your salaries or wages when figuring your total compensation.

Alimony : For IRA purposes, compensation includes any taxable alimony

5. Traditional IRA 개설 시기는요?

- you can open a traditional IRA at any time. However, the time for making contribution for

any year is limited.

6. 언제까지 IRA 에 입금할수 있는가요?

- Contributions can be made to your traditional IRA for each year that you receive compensation and have not reached age 70½. For any year in which you do not work, contributions cannot be made to your IRA unless you receive alimony, nontaxable combat pay, military differential pay, or file a joint return with a spouse who has compensation. Even if contributions cannot be made for the current year, the amounts contributed for years in which you did qualify can remain in your IRA. Contributions can resume for any years that you qualify.

7. 얼마까지 입금 할수 있는가요?

For 2010, the most that can be contributed to your traditional IRA generally is the smaller of the following amounts :

- $5,000($6,000 if you are age 50 or older) or,

- your taxable compensation for the year

- Spousal IRA Limit

For 2010, if you file a joint return and your taxable compensation is less than that of your spouse, the most that can be contributed for the year to your IRA is the smaller of the following two amounts:

- $5,000 ($6,000 if you are age 50 or older), or

- The total compensation includible in the gross income of both you and your spouse for the year, reduced by the following two amounts.

Example.

Kristin, a full-time student with no taxable compensation, marries Carl during the year. Neither was age 50 by the end of 2010. For the year, Carl has taxable compensation of $30,000. He plans to contribute (and deduct) $5,000 to a traditional IRA. If he and Kristin file a joint return, each can contribute $5,000 to a traditional IRA. This is because Kristin, who has no compensation, can add Carl's compensation, reduced by the amount of his IRA contribution, ($30,000 – $5,000 = $25,000) to her own compensation (-0-) to figure her maximum contribution to a traditional IRA. In her case, $5,000 is her contribution limit, because $5,000 is less than $25,000 (her compensation for purposes of figuring her contribution

8. Tax 계산시 얼마까지 공제 받을수 있나요?

Generally, you can deduct the lesser of:

Reduced or no deduction. If either you or your spouse was covered by an employer retirement plan, you may be entitled to only a partial (reduced) deduction or no deduction at all, depending on your income and your filing status.

9. IRA 에서 인출하는 금액은 과세대상 인가요?

In general, distributions from a traditional IRA are taxable in the year you receive them.

10. 언제 IRA 에서 인출 할수 있나요?

You can withdraw or use your traditional IRA assets at any time. However, a 10% additional tax generally applies if you withdraw or use IRA assets before you are age 59½. This is explained under Age 59½ Rule under Early Distributions, later.

You generally can make a tax-free withdrawal of contributions if you do it before the due date for filing your tax return for the year in which you made them. This means that, even if you are under age 59½, the 10% additional tax may not apply.

11. 조기 인출할수 있나요?

- early distributions generally are amounts distributed from your traditional IRA account or annuity before your age 59 ½

- age 59 ½ rule : generally, if you are under age 59 ½, you must pay 10% additional tax on the distribution of any assets(money or other property) from your traditional IRA.

- exceptions :

(1) you have unreimbursed medical expenses that are more than 7.5% of your adjusted gross income

(2) the distribution are not more than the cost of your medical insurance.

(3) you are disabled

(4) you are the beneficiary of a deceased IRA owner.

(5) you are receiving distributions in the form of an annuity.

(6) the distributions are not more than your qualified higher education expenses.

(7) you use the distribution to buy, build, or rebuild a first home.

12. Roth IRA 로 전환할수 있나요?

Starting in 2010, the $100,000 modified AGI limit and the filing status requirements for converting a traditional IRA to a Roth IRA have been eliminated.

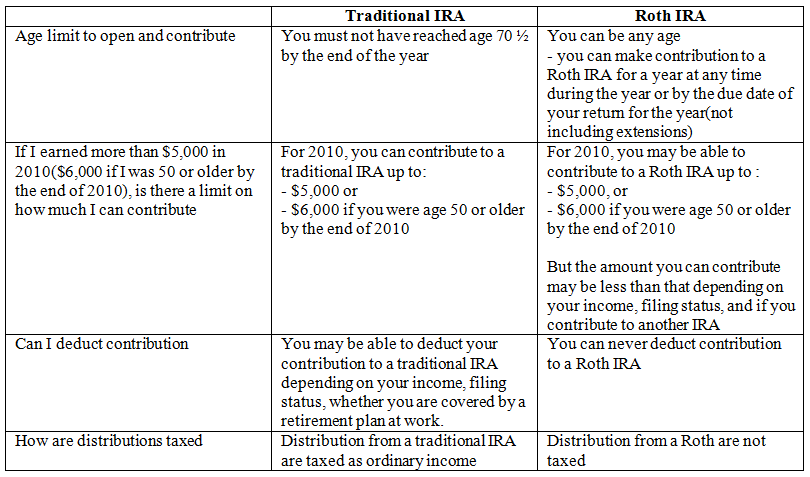

13. Traditional IRA vs. Roth IRA 비교

personal savings plan that gives you tax advantage for setting aside money for retirement

2. IRA Tax 혜택은 어떻게 되나요?

- contribution you make to an IRA may be fully or partially deductible.

- generally, amounts in your IRA(including earnings and gains) are not taxed until distributed.

3. Traditional IRA 은 누가 개설할수 있는가요?

You can open and make contribution to traditional IRA if

- you(or, if you file a joint return, your spouse) received taxable compensation during the year,

and

- you were not age 7 ½ by the end of year.

- If both you and your spouse have compensation and are under age 70½, each of you can open

an IRA. You cannot both participate in the same IRA. If you file a joint return, only one of you

needs to have compensation

4. IRA 개설시 요구하는 "Compensation" 이란 무엇인가요?

Wages, salaries, etc : Wages, salaries, tips, professional fees, bonuses, and other amounts you

receive for providing personal services are compensation.

Commissions : An amount you receive that is a percentage of profits or sales price is

compensation.

Self-employment income : If you are self-employed (a sole proprietor or a partner),

compensation is the net earnings from your trade or business

Self-employment loss : If you have a net loss from self-employment, do not subtract the loss

from your salaries or wages when figuring your total compensation.

Alimony : For IRA purposes, compensation includes any taxable alimony

5. Traditional IRA 개설 시기는요?

- you can open a traditional IRA at any time. However, the time for making contribution for

any year is limited.

6. 언제까지 IRA 에 입금할수 있는가요?

- Contributions can be made to your traditional IRA for each year that you receive compensation and have not reached age 70½. For any year in which you do not work, contributions cannot be made to your IRA unless you receive alimony, nontaxable combat pay, military differential pay, or file a joint return with a spouse who has compensation. Even if contributions cannot be made for the current year, the amounts contributed for years in which you did qualify can remain in your IRA. Contributions can resume for any years that you qualify.

7. 얼마까지 입금 할수 있는가요?

For 2010, the most that can be contributed to your traditional IRA generally is the smaller of the following amounts :

- $5,000($6,000 if you are age 50 or older) or,

- your taxable compensation for the year

- Spousal IRA Limit

For 2010, if you file a joint return and your taxable compensation is less than that of your spouse, the most that can be contributed for the year to your IRA is the smaller of the following two amounts:

- $5,000 ($6,000 if you are age 50 or older), or

- The total compensation includible in the gross income of both you and your spouse for the year, reduced by the following two amounts.

- Your spouse's IRA contribution for the year to a traditional IRA.

- Any contributions for the year to a Roth IRA on behalf of your spouse.

Example.

Kristin, a full-time student with no taxable compensation, marries Carl during the year. Neither was age 50 by the end of 2010. For the year, Carl has taxable compensation of $30,000. He plans to contribute (and deduct) $5,000 to a traditional IRA. If he and Kristin file a joint return, each can contribute $5,000 to a traditional IRA. This is because Kristin, who has no compensation, can add Carl's compensation, reduced by the amount of his IRA contribution, ($30,000 – $5,000 = $25,000) to her own compensation (-0-) to figure her maximum contribution to a traditional IRA. In her case, $5,000 is her contribution limit, because $5,000 is less than $25,000 (her compensation for purposes of figuring her contribution

8. Tax 계산시 얼마까지 공제 받을수 있나요?

Generally, you can deduct the lesser of:

- The contributions to your traditional IRA for the year, or

- The general limit (or the spousal IRA limit, if applicable)

Reduced or no deduction. If either you or your spouse was covered by an employer retirement plan, you may be entitled to only a partial (reduced) deduction or no deduction at all, depending on your income and your filing status.

9. IRA 에서 인출하는 금액은 과세대상 인가요?

In general, distributions from a traditional IRA are taxable in the year you receive them.

10. 언제 IRA 에서 인출 할수 있나요?

You can withdraw or use your traditional IRA assets at any time. However, a 10% additional tax generally applies if you withdraw or use IRA assets before you are age 59½. This is explained under Age 59½ Rule under Early Distributions, later.

You generally can make a tax-free withdrawal of contributions if you do it before the due date for filing your tax return for the year in which you made them. This means that, even if you are under age 59½, the 10% additional tax may not apply.

11. 조기 인출할수 있나요?

- early distributions generally are amounts distributed from your traditional IRA account or annuity before your age 59 ½

- age 59 ½ rule : generally, if you are under age 59 ½, you must pay 10% additional tax on the distribution of any assets(money or other property) from your traditional IRA.

- exceptions :

(1) you have unreimbursed medical expenses that are more than 7.5% of your adjusted gross income

(2) the distribution are not more than the cost of your medical insurance.

(3) you are disabled

(4) you are the beneficiary of a deceased IRA owner.

(5) you are receiving distributions in the form of an annuity.

(6) the distributions are not more than your qualified higher education expenses.

(7) you use the distribution to buy, build, or rebuild a first home.

12. Roth IRA 로 전환할수 있나요?

Starting in 2010, the $100,000 modified AGI limit and the filing status requirements for converting a traditional IRA to a Roth IRA have been eliminated.

13. Traditional IRA vs. Roth IRA 비교